What Is Vat Discount . This tax is associated with shopping in the. — what is vat? It is an indirect tax on the consumption of goods and services in. — this quick reference guide provides information and guidelines regarding the vat treatment of non. you can pay your vat electronically by using efiling or by making an electronic funds transfer (eft) through internet banking. — differences in the classification of allowances (including discounts, rebates and incentives) in the. recently the south african revenue service released binding general ruling 6, in which it rather briefly deals with the issue of early. the standard vat rate of 15% applies to all supplies of goods or services (which do not qualify for the zero rate, an exemption or another exception), the.

from www.mondaq.com

the standard vat rate of 15% applies to all supplies of goods or services (which do not qualify for the zero rate, an exemption or another exception), the. This tax is associated with shopping in the. recently the south african revenue service released binding general ruling 6, in which it rather briefly deals with the issue of early. — this quick reference guide provides information and guidelines regarding the vat treatment of non. — differences in the classification of allowances (including discounts, rebates and incentives) in the. — what is vat? It is an indirect tax on the consumption of goods and services in. you can pay your vat electronically by using efiling or by making an electronic funds transfer (eft) through internet banking.

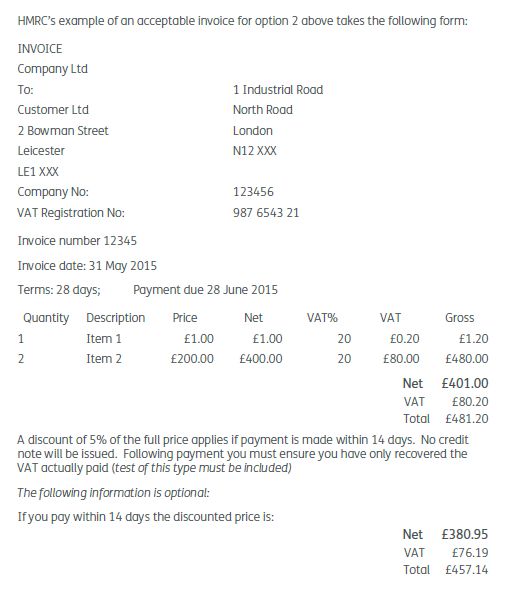

Changes To The VAT Treatment Of Prompt Payment Discounts Sales Taxes

What Is Vat Discount — what is vat? It is an indirect tax on the consumption of goods and services in. — what is vat? — differences in the classification of allowances (including discounts, rebates and incentives) in the. recently the south african revenue service released binding general ruling 6, in which it rather briefly deals with the issue of early. This tax is associated with shopping in the. — this quick reference guide provides information and guidelines regarding the vat treatment of non. the standard vat rate of 15% applies to all supplies of goods or services (which do not qualify for the zero rate, an exemption or another exception), the. you can pay your vat electronically by using efiling or by making an electronic funds transfer (eft) through internet banking.

From dxojtbuau.blob.core.windows.net

Calculate Sales Discount Accounting at Emmanuel Johnson blog What Is Vat Discount the standard vat rate of 15% applies to all supplies of goods or services (which do not qualify for the zero rate, an exemption or another exception), the. — what is vat? This tax is associated with shopping in the. you can pay your vat electronically by using efiling or by making an electronic funds transfer (eft). What Is Vat Discount.

From jon-mielke.blogspot.com

how to add vat to a price What Is Vat Discount recently the south african revenue service released binding general ruling 6, in which it rather briefly deals with the issue of early. It is an indirect tax on the consumption of goods and services in. — this quick reference guide provides information and guidelines regarding the vat treatment of non. — what is vat? — differences. What Is Vat Discount.

From www.youtube.com

Discount & VAT Explanation and Type 7 YouTube What Is Vat Discount recently the south african revenue service released binding general ruling 6, in which it rather briefly deals with the issue of early. you can pay your vat electronically by using efiling or by making an electronic funds transfer (eft) through internet banking. — what is vat? It is an indirect tax on the consumption of goods and. What Is Vat Discount.

From www.mondaq.com

Changes To The VAT Treatment Of Prompt Payment Discounts Sales Taxes What Is Vat Discount This tax is associated with shopping in the. — what is vat? It is an indirect tax on the consumption of goods and services in. recently the south african revenue service released binding general ruling 6, in which it rather briefly deals with the issue of early. you can pay your vat electronically by using efiling or. What Is Vat Discount.

From help.tallysolutions.com

How to Calculate VAT After Discount in TallyPrime TallyHelp What Is Vat Discount It is an indirect tax on the consumption of goods and services in. recently the south african revenue service released binding general ruling 6, in which it rather briefly deals with the issue of early. you can pay your vat electronically by using efiling or by making an electronic funds transfer (eft) through internet banking. — this. What Is Vat Discount.

From informi.co.uk

How is VAT affected by discounts? Informi What Is Vat Discount This tax is associated with shopping in the. It is an indirect tax on the consumption of goods and services in. — what is vat? — differences in the classification of allowances (including discounts, rebates and incentives) in the. — this quick reference guide provides information and guidelines regarding the vat treatment of non. the standard. What Is Vat Discount.

From xlsxtemplates.com

GCC VAT With Discount excel template for free What Is Vat Discount recently the south african revenue service released binding general ruling 6, in which it rather briefly deals with the issue of early. — this quick reference guide provides information and guidelines regarding the vat treatment of non. It is an indirect tax on the consumption of goods and services in. — differences in the classification of allowances. What Is Vat Discount.

From exceldatapro.com

Download UK VAT Invoice With Discount Excel Template ExcelDataPro What Is Vat Discount — what is vat? — differences in the classification of allowances (including discounts, rebates and incentives) in the. This tax is associated with shopping in the. you can pay your vat electronically by using efiling or by making an electronic funds transfer (eft) through internet banking. the standard vat rate of 15% applies to all supplies. What Is Vat Discount.

From www.youtube.com

Profit,Loss,VAT and Discountpart II(class 8,9and10)Short questions What Is Vat Discount you can pay your vat electronically by using efiling or by making an electronic funds transfer (eft) through internet banking. — differences in the classification of allowances (including discounts, rebates and incentives) in the. This tax is associated with shopping in the. the standard vat rate of 15% applies to all supplies of goods or services (which. What Is Vat Discount.

From www.youtube.com

VAT INVOICE with discount YouTube What Is Vat Discount It is an indirect tax on the consumption of goods and services in. This tax is associated with shopping in the. — what is vat? — differences in the classification of allowances (including discounts, rebates and incentives) in the. recently the south african revenue service released binding general ruling 6, in which it rather briefly deals with. What Is Vat Discount.

From informi.co.uk

How is VAT affected by discounts? Informi What Is Vat Discount This tax is associated with shopping in the. recently the south african revenue service released binding general ruling 6, in which it rather briefly deals with the issue of early. It is an indirect tax on the consumption of goods and services in. the standard vat rate of 15% applies to all supplies of goods or services (which. What Is Vat Discount.

From www.tide.co

VAT invoice requirements Tide Business What Is Vat Discount — differences in the classification of allowances (including discounts, rebates and incentives) in the. This tax is associated with shopping in the. the standard vat rate of 15% applies to all supplies of goods or services (which do not qualify for the zero rate, an exemption or another exception), the. It is an indirect tax on the consumption. What Is Vat Discount.

From www.rappler.com

AskTheTaxWhiz VAT exemptions, discounts for PWDs What Is Vat Discount you can pay your vat electronically by using efiling or by making an electronic funds transfer (eft) through internet banking. — differences in the classification of allowances (including discounts, rebates and incentives) in the. This tax is associated with shopping in the. — what is vat? the standard vat rate of 15% applies to all supplies. What Is Vat Discount.

From help.eventtia.com

How do charges, VAT (Valued Added Tax) and discount coupons work at What Is Vat Discount This tax is associated with shopping in the. — this quick reference guide provides information and guidelines regarding the vat treatment of non. — differences in the classification of allowances (including discounts, rebates and incentives) in the. It is an indirect tax on the consumption of goods and services in. the standard vat rate of 15% applies. What Is Vat Discount.

From help.tallysolutions.com

How to Calculate VAT After Discount in TallyPrime TallyHelp What Is Vat Discount recently the south african revenue service released binding general ruling 6, in which it rather briefly deals with the issue of early. It is an indirect tax on the consumption of goods and services in. This tax is associated with shopping in the. — this quick reference guide provides information and guidelines regarding the vat treatment of non.. What Is Vat Discount.

From www.svtuition.org

Journal Entries of VAT Accounting Education What Is Vat Discount It is an indirect tax on the consumption of goods and services in. the standard vat rate of 15% applies to all supplies of goods or services (which do not qualify for the zero rate, an exemption or another exception), the. — differences in the classification of allowances (including discounts, rebates and incentives) in the. — what. What Is Vat Discount.

From www.youtube.com

Accounting for settlement discounts for debtors/creditors & VAT What Is Vat Discount — this quick reference guide provides information and guidelines regarding the vat treatment of non. recently the south african revenue service released binding general ruling 6, in which it rather briefly deals with the issue of early. you can pay your vat electronically by using efiling or by making an electronic funds transfer (eft) through internet banking.. What Is Vat Discount.

From help.tallysolutions.com

How to Calculate VAT After Discount in TallyPrime TallyHelp What Is Vat Discount This tax is associated with shopping in the. — this quick reference guide provides information and guidelines regarding the vat treatment of non. recently the south african revenue service released binding general ruling 6, in which it rather briefly deals with the issue of early. It is an indirect tax on the consumption of goods and services in.. What Is Vat Discount.